how to become cpa lawyer

It does not matter if you are managing a lot of money or a little. For someone else you are a fiduciary.

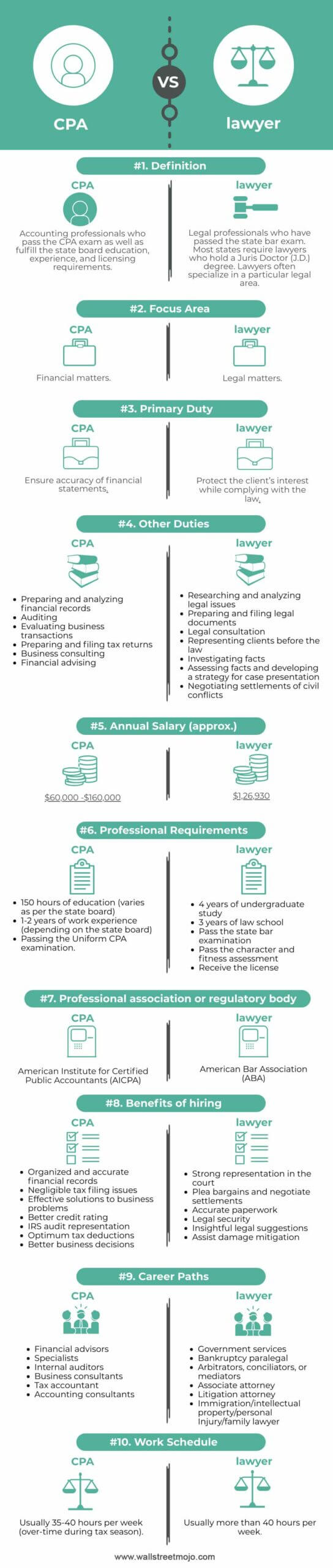

Cpa Vs Lawyer Top 10 Best Differences With Infographics

The two most important aspects of becoming a CPA are passing the Uniform CPA Exam and.

. Since most states require 150 semester hours to become a CPA you may need to earn a masters degree to meet this requirement. Register for the CPA Exam after meeting the exam requirements to become a CPA. Before you enter law school you need to be a holder of a baccalaureate degree and must meet certain number of units of certain subjects in your college transcript di.

The main requirement to be a CPA is to have at least 150 hours of college credit. After your application is processed you will be issued a Notice to Schedule NTS. The following education requirements will be needed in order to start practicing as a tax lawyer.

All 55 licensing jurisdictions have a minimum age requirement of 18-years-old to apply for the CPA exam. Become A Lawyer Soon. Total cost 104496 registration fees.

From there you fill out the application to take the exam. Apply for a summer internship at a tax law firm after your first year of law school to gain valuable experience and increase your chances of finding employment after. In the context of CPA vs lawyer the primary difference between a.

Becoming dually-qualified gives you far greater insight and perspective than your average lawyer or accountant. There is no one right way to prepare to sit for the CPA Exam. Read the court order closely.

Ad Find Colleges Universities That Prepare You to Become a CPA. Juris Doctor Law Degree. Learn what it takes to become a lawyer in the Philippines with this step-by-step guide written by a Filipino attorney.

You want to be a. Ad We help you uncover the secret to passing CPA exam. First apply to become a CPA Australia member complete the CPA programme meet your experience requirements make sure you have a degree.

Ad Earn Your Law Degree To Further Your Law Career. Study for and then pass the CPA Exam passing will be much easier if you know. Master concepts with ease.

CPA education requirements include a bachelors degree and at least 150 credit-hours of coursework. Some schools offer a combined five-year. The Power Of The Dual View.

They also may be written in the court order that appointed you. Some court orders may be detailed while others may be very general. Equip Yourself With The Skills Needed To Succeed In Todays World Of Finance Accounting.

You will have to wait a few years in order to start your. Both Certified Public Accountants CPA and lawyers are licensed professionals in their respective fields of accounting and law. Become A Lawyer Soon.

How To Become a Lawyer in the Philippines. Well to start with anything a non CPA lawyer can do. Schedule your CPA Exam.

Why CPAs Should Consider A Law Degree. Get real CPA Exam questions and comprehensive explanations. Ad Earn Your Law Degree To Further Your Law Career.

A recent Robert Half report. You have completed 15 years of schooling and know what works for you. Once this step is completed they must.

Request Free Info From Schools and Choose the One Thats Right For You. A CPA lawyer is simply someone who is both a CPA and a lawyer. While many people who sit for the CPA exams have their masters degrees this is not necessarily a.

The law requires you to manage Robertos money for HIS benefit not yours. Ad This Certification Proves Your Mastery Of The 12 Practice Areas In Management Accounting. Then youre officially a CPA and.

Most states charge around 900 for the entire exam. Typically CPA candidates must have at least 24 college credit hours in auditing taxation and accounting education as well as 30 credit hours of business-related course like. Lawyers can obtain the CPA designation by completing 150 semester hours of education at the undergraduate or graduate level.

Are written in state law. A CPA is a certified public accountant who is licensed by a state board of accountancy. What can a CPA lawyer do.

Emotional intelligence the ability to relate and engage well with others can also help you advance in your CPA career. You do not need to major in accounting or business though it is. Answer 1 of 7.

Differences Between Cpas And Tax Attorneys Milikowsky Tax Law

Cpa Vs Tax Attorney Top 10 Differences With Infographics

What Is A Cpa Lawyer And What Do They Do Quora

Accounting Jobs Accounting Career Accounting Major

What Does An Accounting Lawyer Do Best Accounting Degrees

Are Lawyers Rich How To Get Rich As A Lawyer About Rich Lawyers And Lawyers Money Be Rich Law School Life Law School Preparation Law School Prep

A Certified Public Accountant Or Cpa Plays A Very Vital Role In Any Business S Financial Management Goo Gl 5k Accounting Certified Public Accountant Financial

Why You Want A Tax Attorney To Help You With A Tax Problem Instead Of Or In Addition To A Cpa Or Tax Service

7 Skills Cpas Need And How To Get Them Robert Half

Amazon Com Lawyers Are Liars The Truth About Protecting Our Assets 9780979738500 Mark J Kohler Kohler Mark J Books Liar Lawyer Truth

Boutique Intellectual Property Firm Incubators And Accelerators In Australia Intellectual Property Lawyer Branding Advice Medical Technology

How To Become A Cpa Lawyer In The Philippines What Is The Process From The Beginning Quora

The Power Of The Dual View Cpas Should Consider A Law Degree

Cpa Vs Tax Attorney Top 10 Differences With Infographics

The Power Of The Dual View Cpas Should Consider A Law Degree

Differences Between Solicitors And Barristers Barrister Solicitor Career Development